Bryant Veney - Copywriter, CableCompare

Date Modified: February 11, 2026

“Cutting the cord.” That’s a phrase that seemed a bit funny in the early 2000s and 2010s but now, in 2025, tens of millions of cable TV customers have done exactly that. They’ve cut the cord. And the trend isn’t slowing down. By 2027, forecasts show a 38-percentage-point drop in household paid TV subscriptions compared to 2010.

But what did “cutting the cord” really mean when people first started saying it? It meant ditching the outdated model of bundling hundreds of cable channels, most of which they never watched, for something smarter. Streaming services like Netflix, Hulu, Max, and niche platforms like Crunchyroll or Viki changed the game. Suddenly, customers could pay for exactly what they wanted, at a fraction of the cost. And not only were they saving money skipping useless programming, but they were also getting more of the content they actually cared about.

Take this as an example: some customers subscribed to Netflix just to experience the global phenomenon that was Squid Game, but they stuck around for the sheer brilliance of Wednesday. Quick question, do you still have a cable subscription? Our guess is no, but let us break down, why we came to that assumption.

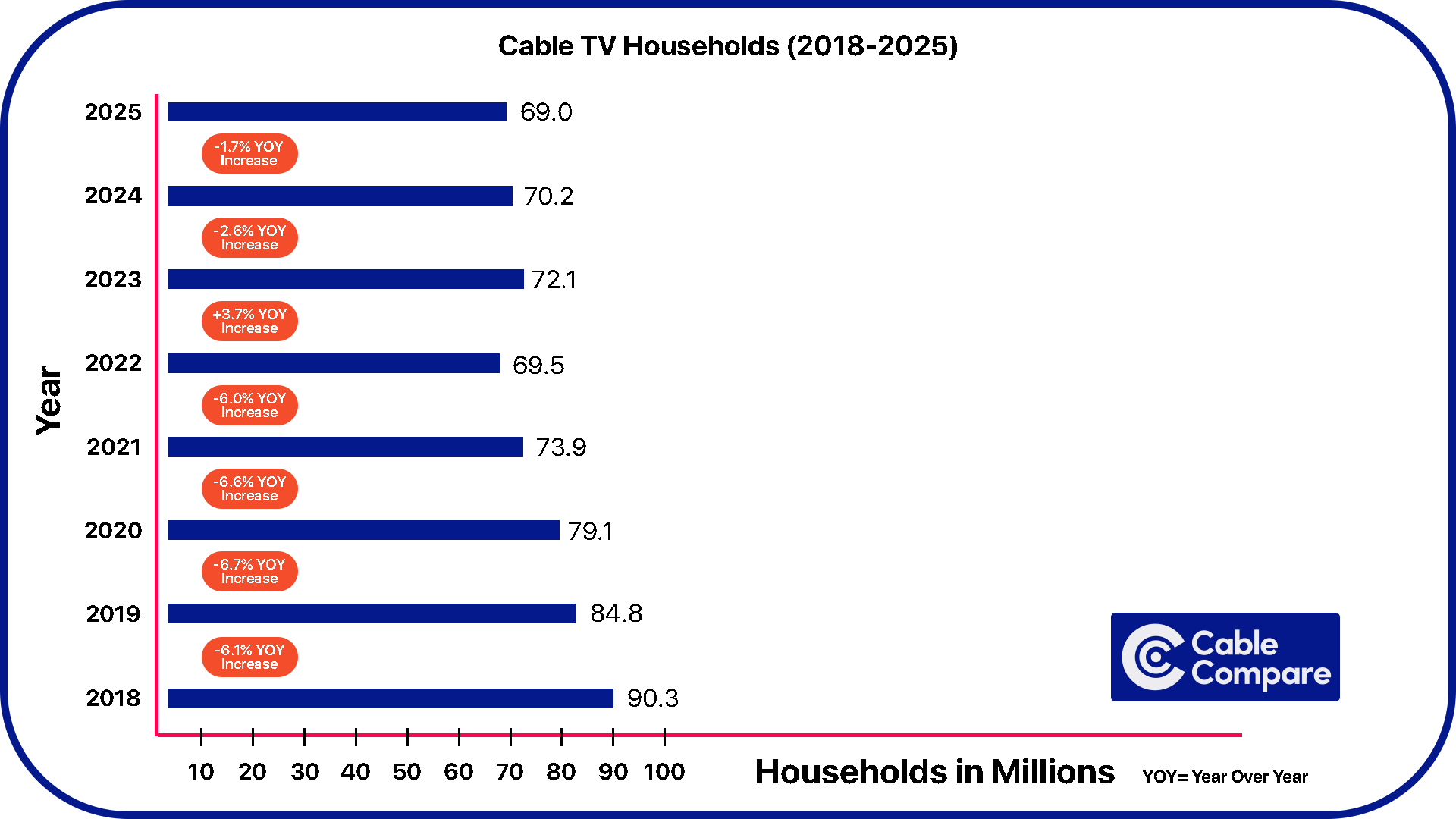

As of 2025, 68.7 million U.S. households still subscribe to cable TV. And sure, 69 million might sound like a lot—but when you compare that to the 105 million households subscribed in 2010, the drop becomes staggering. In just 15 years, pay TV has lost over a third of its customer base.

But how does a decline like this happen? Penetration rate. But what exactly is TV penetration rate you may be asking? In the context of television, penetration rate refers to the percentage of households (or a specific target audience) that own or subscribe to a particular television service or technology. It indicates how widely a specific product, service, or technology has been adopted within a market. This is a huge measure of customers that have and use cable TV.

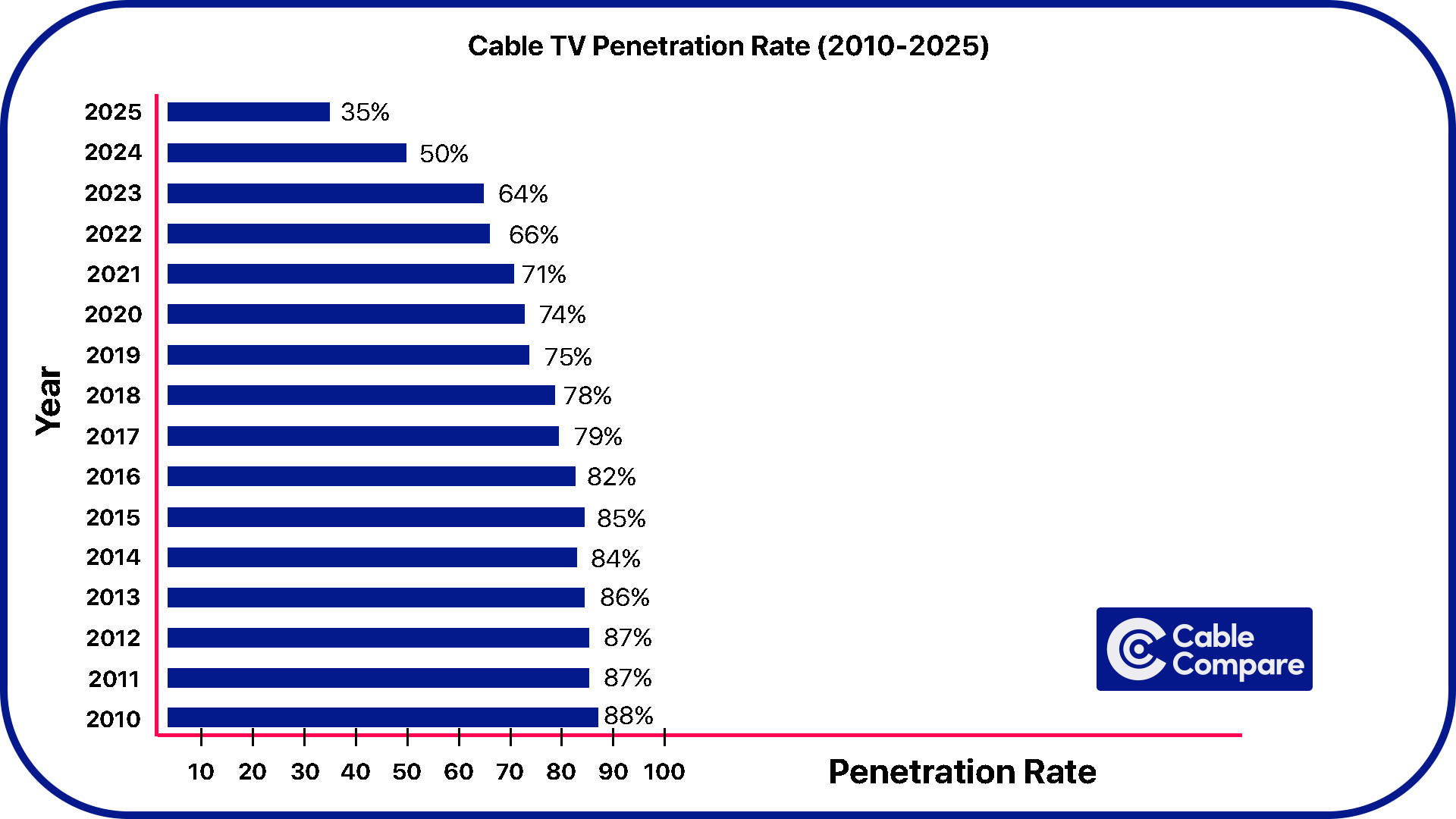

According to nScreenMedia, the cable TV industry saw a huge decline in penetration rate as it significantly dropped between 2010 and 2024. In 2010, it peaked at around 88%. By 2024, it had dropped below 50%, with some sources indicating it was as low as 38.5%

Here’s a chart to show the penetration rates over the past 15 years:

On the flip side of this, cord-cutting households are on the steady increase. From having multiple streaming services or just one specific service, gone are the days of having cable. The convenience, cost-effectiveness, and content variety offered by streaming platforms are major factors contributing to this shift.

According to Evoca, 86.7% of individuals who cut the cord cited the high cost of traditional cable TV as a significant reason for switching to streaming services.

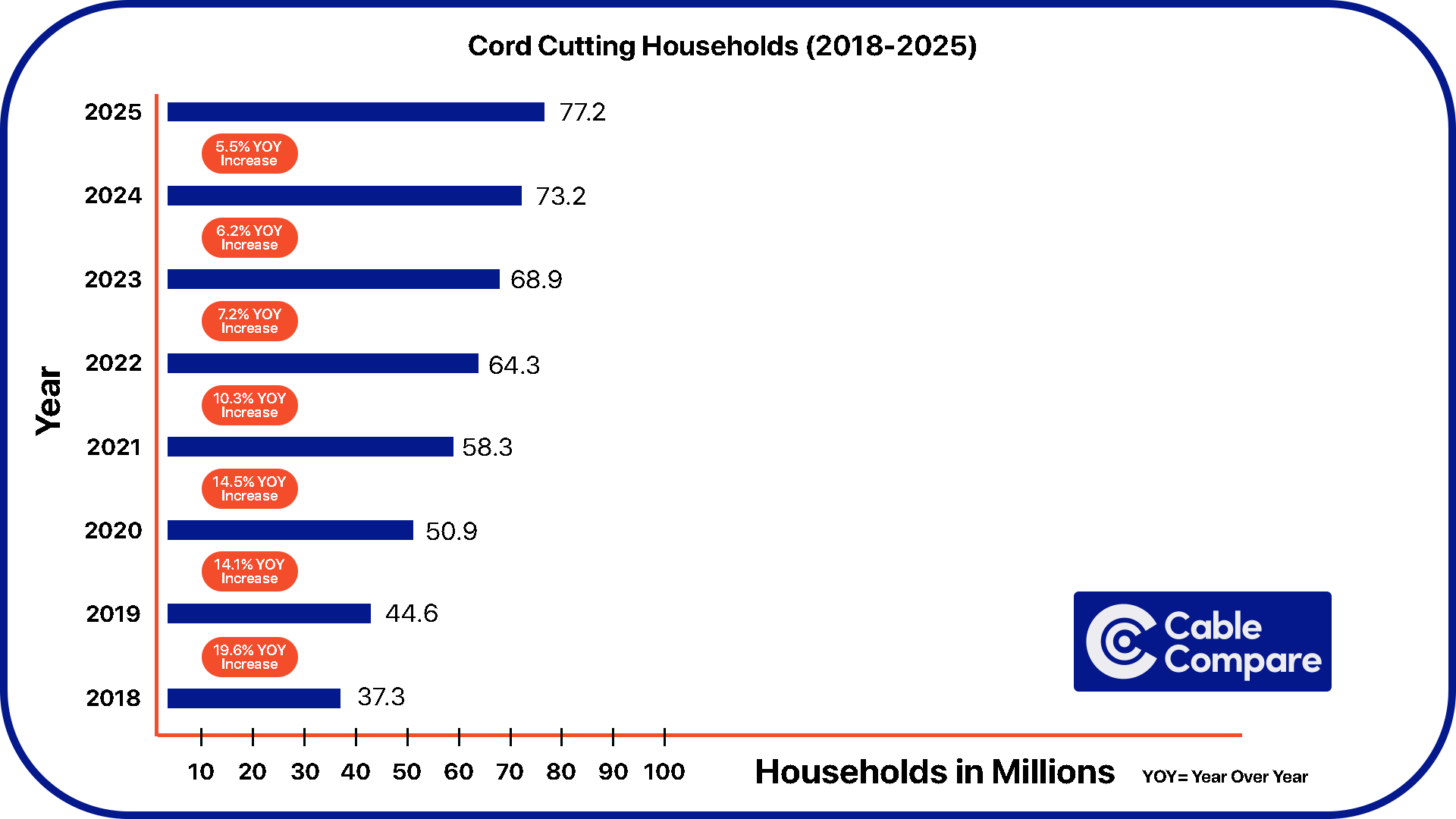

Let’s take a side-by-side look at the growth of cord-cutting households and the decline of traditional cable TV households in the U.S. over the past 7 years:

The data shows a clear shift in how Americans consume television. Since 2018, the number of cord-cutting households has more than doubled, rising from 37.3 million to a projected 77.2 million by 2025. During the same period, traditional cable TV households have steadily declined, dropping from 90.3 million to 69 million. While cable saw a slight bump in 2023, likely due to bundling offers or live sports, it wasn't enough to reverse the long-term trend.

So, what does that mean in dollars? In short: a lot. Pay TV lost an estimated $10.5 billion in revenue between 2020 and 2025. Zoom out a bit more, and the hit is even harder, about $17 billion over the past decade. According to Evoca, TV revenue dropped from $100.09 billion in 2017 to $84.29 billion in 2024. A 16.5% decline in just eight years. And it’s not over yet. By 2027, revenue is projected to plunge even further to $81.33 billion.

According to Nielsen’s Q1 report, cable TV now makes up just 24.5% of total U.S. TV viewership. In contrast, streaming surged ahead, accounting for 44.3%, while broadcast TV still holds 20.8%. The remaining 10.3% comes from other viewing methods like DVRs, gaming consoles, or physical media.

One of the biggest reasons behind cable's decline is the disappearance of compelling new content. A decade ago, basic cable networks were booming, producing a record-high 186 scripted original series in a single year. Today, the number of new scripted series created for traditional cable audiences is virtually zero. Networks that once dominated the TV landscape have largely stopped investing in original programming for cable, choosing instead to develop their own streaming platforms or partner with digital-first studios. In short: the content, and the viewers have moved on.

Millennials and Gen Z have significantly reshaped the cable TV versus streaming landscape. According to Adweek, 50% of consumers under the age of 32 won’t pay for cable TV. In what was once called a cord-cutter who left traditional cable TV for streaming, has birthed a new customer: the cord-never. Which are individuals who have never subscribed to traditional pay TV services like cable or satellite and instead rely solely on different forms of entertainment.

Viewing Flexibility

Content Access

Cost & Commitment

Ad Experience

Social & Cultural

By 2026, over 80.7 million U.S. households are expected to use non-pay TV services. That means the majority of American viewers will either be cord-cutters or cord-nevers—permanently shifting away from cable TV.

This transformation is being driven by:

As traditional cable continues to lose ground to streaming, major industry players are being forced to adapt, or risk becoming obsolete. Enter the Charter-Cox merger, a bold $34.5 billion move that signals just how serious the shift away from cable has become.

First reported by AP News, this isn’t just a partnership. Charter, the company behind Spectrum, is acquiring Cox Communications, forming a telecom giant with over 38 million customers nationwide.

Why Now? Short answer: survival through consolidation.

Both companies have seen cable TV subscribers drop dramatically. Even broadband growth, once a safety net, has begun to slow. By joining forces, Charter and Cox aim to:

This merger makes them the largest cable and internet provider in the U.S., surpassing even Comcast. That kind of scale gives them the power to negotiate better deals, push back against rising challengers like Verizon and T-Mobile, and compete with growing disruptors like EarthLink LLC.

Bottom line? As streaming dominates and cord-cutting accelerates, cable companies must consolidate, evolve, or disappear. Expect more mergers and aggressive strategies as these legacy giants fight for relevance in an on-demand world.

Still considering cable? Compare cable TV options in your area to find the best deals and packages available by ZIP code.